Bitcoin to 100K has become one of the hottest topics in the financial world.

As the world’s leading cryptocurrency, Bitcoin has the ability for capturing attention, especially when it edges closer to significant milestones.

With speculations mounting about Bitcoin reaching the $100,000 mark in the months ahead, excitement is building across the crypto community.

But is this target realistic, or is it just wishful thinking? Let’s dive into three key reasons why this price target might soon become a reality.

Pro-Crypto U.S. Candidates: Bitcoin to 100K?

One of the key factors driving the potential rise in Bitcoin’s price is the pro-crypto stance of both 2024 U.S. presidential candidates—Donald Trump and Kamala Harris. While each candidate has a different approach to the crypto market, their outlook suggests a more favorable regulatory environment for Bitcoin and other digital assets.

Trump’s Ambitious Vision

Donald Trump has made a notable shift in his stance on cryptocurrencies. Once a skeptic, he now aims to position the United States as a global leader in the digital asset space.

Trump envisions making America the “crypto capital,” with policies that could encourage institutional investments and create a more accommodating landscape for Bitcoin. Trump even suggested that the government could pay off its $35 trillion national debt with bitcoin.

With fewer restrictions and a focus on deregulation, Trump’s administration could pave the way for a surge in Bitcoin’s adoption and, consequently, its price.

Harris’ Balanced Approach

While Kamala Harris may be more cautious compared to Trump, her administration is also expected to embrace digital assets to some extent. Instead of pushing for heavy-handed regulations, Harris might focus on integrating crypto within existing frameworks.

Her administration could maintain a balanced approach, which, when combined with broader fiscal policies, could still provide a favorable environment for Bitcoin.

Regardless of who wins the election, the potential for policy shifts toward a pro-crypto stance could be a catalyst for Bitcoin’s rise, especially if the U.S. makes efforts to provide regulatory clarity and support to the crypto industry.

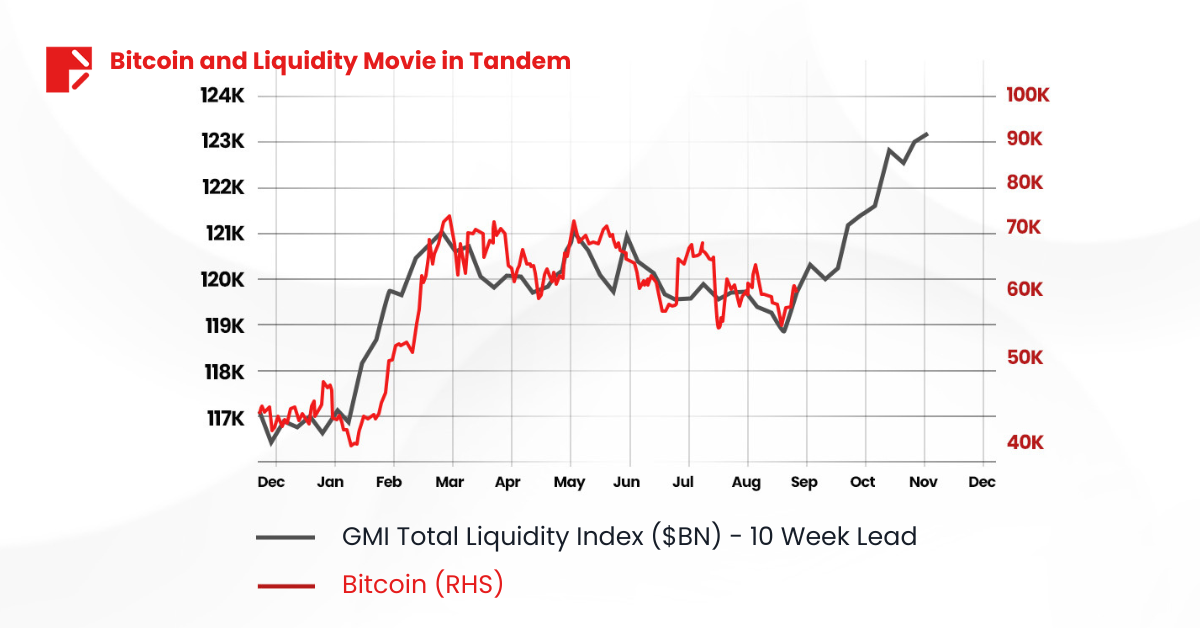

A Fresh Wave of Liquidity from Global Markets

Beyond the political landscape, global economic dynamics are also aligning in Bitcoin’s favor. One of the most critical factors here is the inflow of liquidity, particularly from China, with the U.S. and the European Union expected to follow. This wave of economic stimulus could provide significant fuel for a bullish Bitcoin run.

China’s Economic Stimulus

China has been injecting substantial liquidity into its markets, aiming to stimulate its economy amid a challenging global environment. This increase in liquidity tends to drive investors toward riskier assets, including cryptocurrencies. Historically, when liquidity flows into the market, investors seek higher returns, making digital assets like Bitcoin more appealing.

U.S. and EU Following Suit

As the U.S. and European economies continue to navigate inflationary pressures and growth concerns, they too are expected to introduce further economic support measures.

Central banks may use stimulus packages or monetary easing to ensure their economies stay afloat. This global liquidity boost can create an environment where investors seek out assets that can offer potential upside, and Bitcoin, with its track record of high returns, stands as a prime candidate.

When these major economies start injecting liquidity, it often correlates with an increase in demand for alternative assets like Bitcoin, pushing prices higher. The combination of a pro-crypto stance and ample liquidity could create the perfect storm for a Bitcoin rally.

Falling Interest Rates: A Classic Bullish Signal for Bitcoin

Another major factor working in Bitcoin’s favor is the trend of falling interest rates across the globe. As central banks struggle with economic uncertainties, many are choosing to cut rates—a move that has historically been bullish for Bitcoin.

Interest Rate Cuts and Risk-On Sentiment

When central banks reduce interest rates, it typically signals a shift towards a more accommodative monetary policy. Lower interest rates mean cheaper borrowing costs, encouraging businesses and individuals to take out loans and invest in various assets, including stocks and cryptocurrencies.

As traditional investment returns diminish due to low rates, investors often turn to riskier assets like Bitcoin, seeking better returns.

Bitcoin as a Hedge Against Economic Uncertainty

Beyond the appeal of higher returns, Bitcoin’s reputation as a digital alternative to gold strengthens during periods of low-interest rates. Investors often view Bitcoin as a hedge against potential currency devaluation and inflation, making it an attractive asset in times when central banks are loosening their monetary policies.

With interest rates dropping around the world, this trend is setting up an environment that could support increased capital flow into Bitcoin. The combination of a “risk-on” sentiment among investors and Bitcoin’s status as a store of value could push it closer to the $100,000 mark.

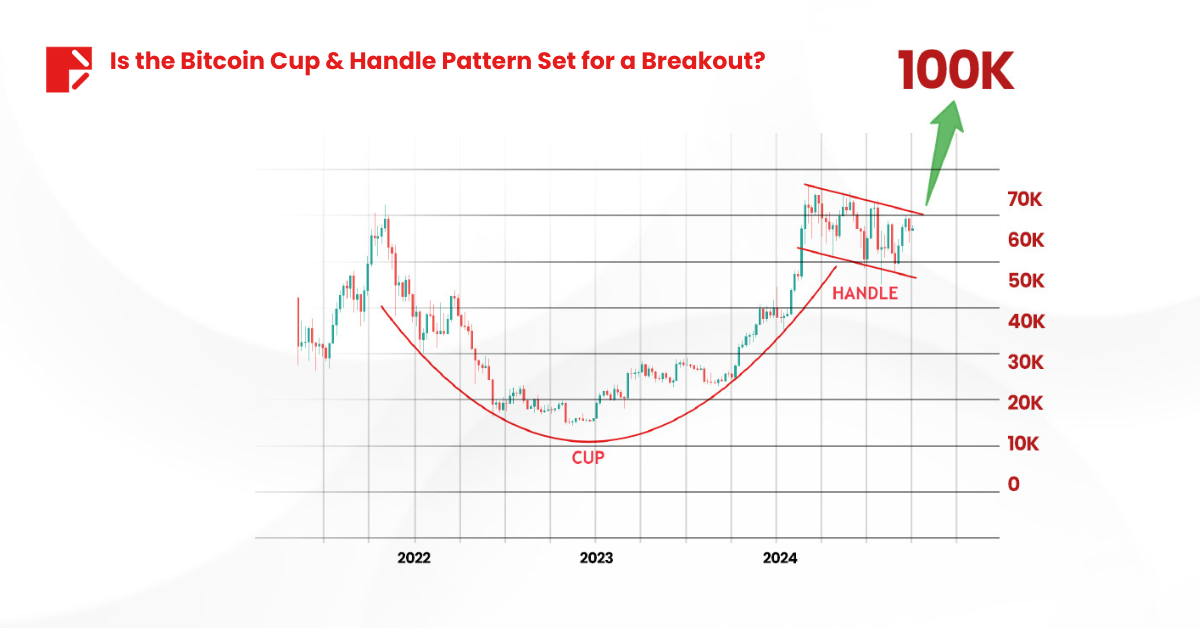

Bitcoin to 100K with a Cup & Handle Pattern

Adding to the bullish sentiment is the formation of a classic cup and handle pattern on Bitcoin’s weekly chart, fueling hopes for Bitcoin to 100K.

This technical pattern is often seen as a signal for a potential breakout, and it mirrors a similar setup that preceded gold’s significant rally from $2,000 to $2,600. The cup shape represents a rounded bottom where prices stabilize after a decline, while the handle suggests a brief consolidation phase before a strong upward movement.

If Bitcoin follows this pattern, it could be on the verge of a major breakout, pushing it closer to the $100,000 mark. Technical analysts see this as a promising sign, with many comparing it to gold’s explosive move, indicating that Bitcoin could be primed for a similar surge.

What’s Next for Bitcoin?

The convergence of these four factors—pro-crypto U.S. presidential candidates, a global wave of liquidity, falling interest rates and the Cup & Handle pattern—paints an optimistic picture for Bitcoin’s price in the coming months. While the crypto market is known for its volatility, these macroeconomic and political tailwinds could be the push Bitcoin needs to reach that $100,000 milestone.

However, it’s crucial to keep in mind that risks remain. Geopolitical tensions, unexpected regulatory changes, or a sudden shift in central bank policies could dampen this bullish outlook. As always, investors should stay informed and approach the market with caution.

Whether or not Bitcoin reaches the $100,000 mark, one thing is clear: the coming months will be pivotal in shaping the future of the cryptocurrency market. And if the stars align, Bitcoin may very well achieve its next major milestone, creating a new chapter in its remarkable story.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.