Since the 25th of June, Tesla’s stock price has risen for eleven consecutive days, achieving a cumulative increase of 44.2%—marking the longest streak of gains since June 2023. For most of this year, Tesla’s performance significantly lagged behind the “Magnificent Seven”, and it was the only company among these giants to have its stock price fall in 2024. However, just one week into the second half of the year, Tesla easily recovered from its losses from the first half.

Investor sentiment towards Tesla has reached a new high for the first time in over three years, betting that there is still room for the stock price to rise further after reaching its highest point in nearly six months. Morgan Stanley has also raised its target price for Tesla to USD 310 and has upgraded its rating to “overweight.” But what exactly has led to this reversal in market sentiment, turning bullish on Tesla? This article will explore the reasons behind this shift.

Turning Point: What Positive Factors Are Driving Tesla’s Rebound?

Elon Musk’s USD 56 Billion Pay Package Approved

At Tesla’s 2024 Annual Shareholder Meeting on the 14th of June, shareholders approved a USD 56 billion pay package for CEO Elon Musk. In January this year, Musk had stated that he would move the development of AI and robotics products out of Tesla if he failed to gain sufficient voting control, using this as leverage to secure approval for his pay package. The approval of the package not only recognizes Musk’s tenure but also reflects the shareholders’ reluctance to risk the company’s future. This ensures the stability of Tesla’s key management, thereby boosting investor optimism.

Second Quarter EV Deliveries Exceed Expectations

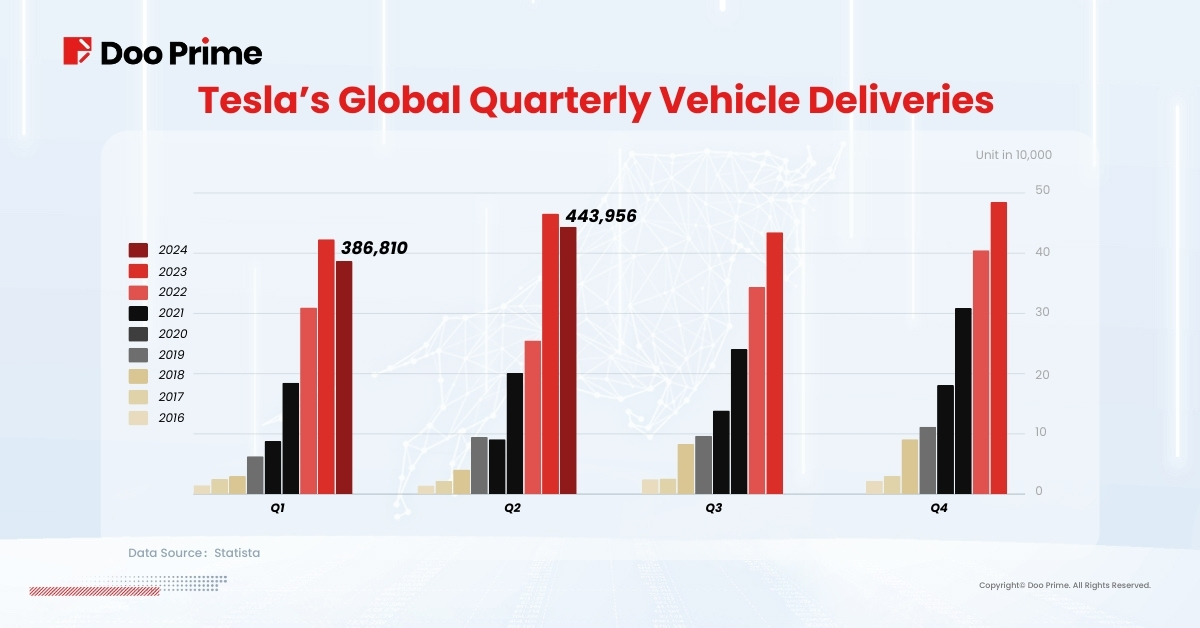

On July 2nd, Tesla released its production and delivery report for the second quarter. The data revealed that Tesla delivered 444,000 vehicles in the second quarter, surpassing market expectations of 439,300 vehicles. Despite a 4.8% year-over-year decline, the drop in deliveries was smaller than the 8.5% decrease observed in the first quarter.

Additionally, Tesla’s sales in its two major markets, China and the United States, exceeded expectations and maintained its position as the global leader in electric vehicle sales. The solid performance in the new energy vehicle sector has bolstered investor confidence, fueling beliefs that Tesla can achieve growth once again.

Moreover, Tesla’s Model Y made its debut on the new energy vehicle procurement list of the Jiangsu provincial government in China in July. At the same time, state-owned enterprises in Shanghai’s Lingang New Area have begun purchasing the Tesla Model Y for corporate use, undoubtedly brightening the sales outlook for the third quarter.

Explosive Growth in Solar and Energy Storage Business

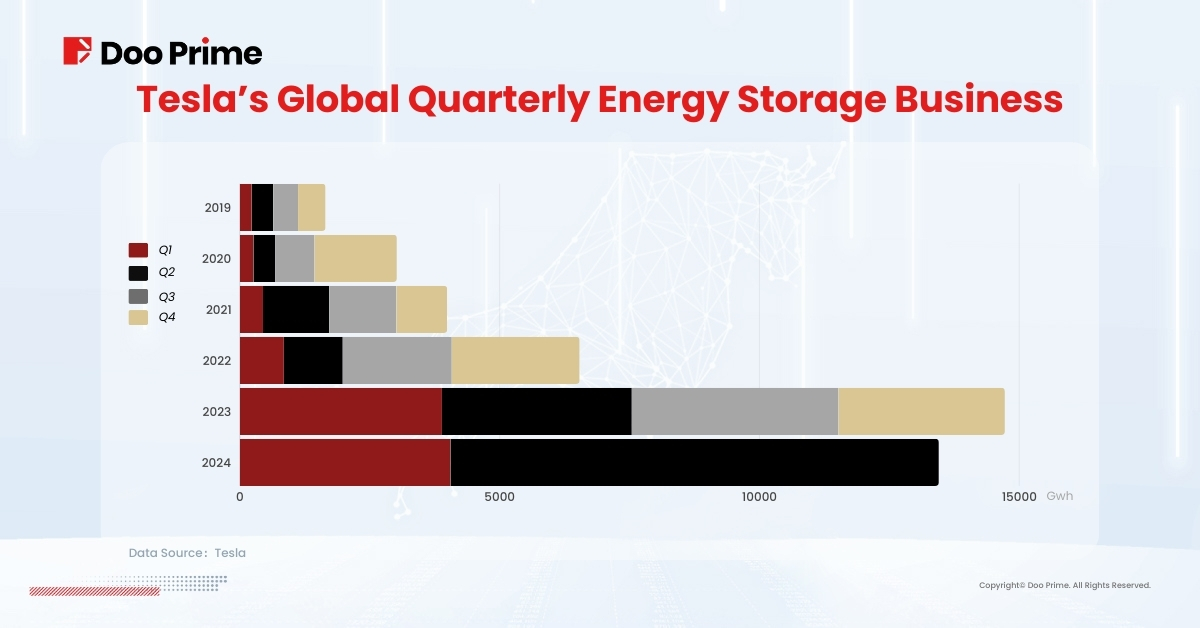

Tesla’s good news extends beyond its vehicle delivery figures. In the second quarter, the company’s solar and energy storage business reached new heights, with a record increase in battery storage capacity for the period.

Tesla Energy, a subsidiary of Tesla, deployed 9.4 GWh of battery storage products in the second quarter of this year, setting a new quarterly record. This represents a 129% increase compared to the previous quarter and a 157% increase compared to the same period last year, demonstrating remarkable growth.

Promising Future for the Optimus Robot

On the 4th of July, at the World Artificial Intelligence Conference (WAIC 2024), Tesla officially unveiled the second generation of its humanoid robot, Optimus. The new Optimus boasts a 30% improvement in upright walking speed. Additionally, its fingers are now capable of precisely estimating the necessary strength for tasks, such as gently gripping an egg or lifting heavy loads.

Recently, the second-generation Optimus began “working” trials in Tesla factories, using visual neural networks and the Full Self-Driving (FSD) chip to mimic human actions for battery sorting training.

At Tesla’s 2024 Annual Shareholder Meeting, Elon Musk highlighted that the valuation of Optimus has been overlooked. He suggested that if Tesla captures 10% of the market in the future, it could earn USD 1 trillion annually from Optimus. Musk believes that solving autonomous driving and successfully mass-producing the Optimus robot will be a major breakthrough for the company.

Responding to the “Bearish on Tesla” sentiment on the social media platform X, Musk stated, “Once Tesla completely solves the autonomous driving issue and mass-produces the Optimus humanoid robot, any short sellers holding Tesla short positions will be “eliminated,” “even Bill Gates is no exception.”

Leading Technological Edge with Robotaxi

Furthermore, Elon Musk plans to host a “Robotaxi Day” event on August 8th, marking the debut of Tesla’s robotic taxi, Robotaxi. This new vehicle will be based on the latest upgraded Full-Self Driving (FSD) technology, creating an autonomous electric taxi. If this event proves to be successful, this could potentially propel Tesla’s stock price even higher.

Tesla’s FSD relies on the Dojo supercomputing chip and NVIDIA’s high-performance AI GPUs to meet the massive demands for training and inference computational power. Several technology leaders, including NVIDIA CEO Jensen Huang, have publicly stated that Tesla’s FSD is the most advanced driver-assistance system available, capable of full autonomous driving in most situations, completely freeing human hands. Huang has said, “Tesla is far ahead in self-driving cars”. Musk has also stated that the robotic taxis will help Tesla become a trillion-dollar company.

Is this Undervalued AI Company Poised for a Comeback?

Despite a significant drop in Tesla’s stock price in the first half of 2024, recent developments have reignited investor confidence. These include the reapproval of Musk’s pay package, injecting certainty into Tesla’s key management, a narrowing decline in electric vehicle deliveries, better-than-expected performance in energy storage business, a significant debut of the second-generation robot Optimus, and a set launch date for Robotaxi.

Following this strong rally, Tesla’s stock price has now surpassed its 50-day, 100-day, and 200-day moving averages. Some optimistic stock analysts believe that Tesla short-sellers are gradually exiting, and the stock price has entered a new “primary uptrend” phase. However, Tesla also faces fierce industry competition and risks associated with the rapid iteration of AI technology.

Investors looking to go long on Tesla should fully understand its advantages and risks, and remain calm and rational. Doo Prime offers over 10,000 trading products, allowing you to build a diversified asset portfolio.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.