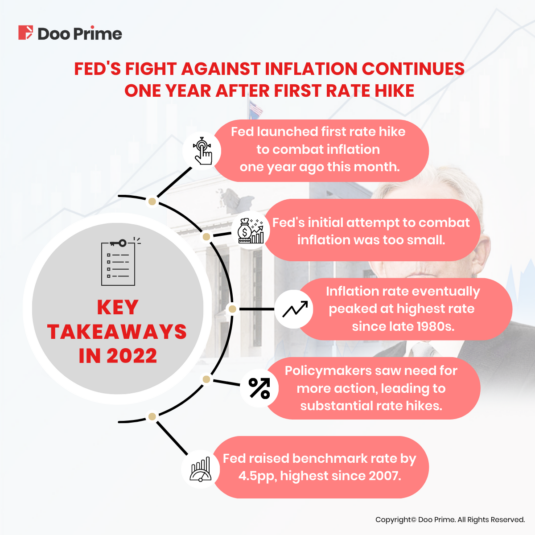

One year ago this month, the Federal Reserve initiated its first attempt to combat inflation that had been building up in the U.S. economy for at least a year.

However, in hindsight, this initial move seems to have been inadequate – only a 0.25% increase to address price surges that eventually peaked at their highest annual rate since the late 1980s within a few months.

The policymakers quickly realized that further action was necessary, leading to more substantial rate hikes in the subsequent months. In total, the Fed raised the benchmark borrowing rate by 4.5 percentage points, which is the highest level since 2007.

Despite a year of fighting against inflation, the current state of affairs is somewhat mediocre. The rate hikes have somewhat subdued the inflation surge that prompted the policy shift, but concerns remain about the timeliness of the Federal Reserve’s actions, and it is uncertain how long it will take the central bank to return to its 2% inflation target.

If you haven’t been following the developments regarding rate hikes and inflation in 2022, we suggest reading “U.S. Inflation Surge – What, How, What’s Next” and “Fed Rate Hikes On Decade High – What, How, What’s Next”.

The articles provide an overview of the decade-high inflation and interest rates that the market experienced in 2022. Thus, in this article, we will delve deeper into why the Federal Reserve is still raising interest rates, how the market is reacting to this move, and what investors could expect next, particularly in the coming year.

Why The Fed Is Still Raising Rates In 2023?

An Inflation Plateau

The primary concern affecting the Federal Reserve’s upcoming decisions is that inflation may not be decreasing as quickly as anticipated. According to Governor Christopher Waller on 2nd March 2023, although inflation has been decreasing since mid-2021, recent data shows that progress has not been as substantial as anticipated.

The strong job market is pushing up wages and service costs, which is a factor in inflation’s slower decline. While inflation decreased in the second half of 2022, January’s data suggests that the rate of decline may be slowing.

The CPI inflation report for February, which is scheduled for release on 14th March 2023, will determine whether January’s economic news was a temporary fluctuation or the beginning of an unwelcome trend for inflation.

If inflation is stagnant, the Federal Reserve has two options. The first is to wait longer for the restrictive policy to take effect. The second option is to raise interest rates further in hopes of reducing prices more rapidly.

At present, the Federal Reserve is leaning towards the second option, with rate increases expected in the March, May, and June meetings. However, these rate increases are likely to be more precise, with 0.25-percentage point increments, compared to the aggressive 0.75-percentage-point moves in 2022.

Nonetheless, the fixed-income markets indicate a one-in-three likelihood that the Federal Reserve may make a 0.5-percentage-point move in March if February’s inflation data shows higher-than-expected rates.

Possible Recession

Apart from policy decisions, the next major issue for the Federal Reserve and financial markets is what would constitute successful management of inflation.

Initially, there was some optimism that higher interest rates, together with better supply and demand balance and supply chain improvements, would help alleviate inflation to some extent.

However, the minutes of the February meeting revealed that the Fed is now aware that below-trend growth might be necessary to curb inflation. This, in turn, could result in a recession in 2023.

While inflation remains the Fed’s top priority, if a recession materializes, the Fed may consider lowering rates to boost the broader economy.

Nevertheless, despite numerous signals pointing to a possible recession, the job market continues to be strong, suggesting that a recession has not yet arrived.

How Markets Reacted To Fed’s Move

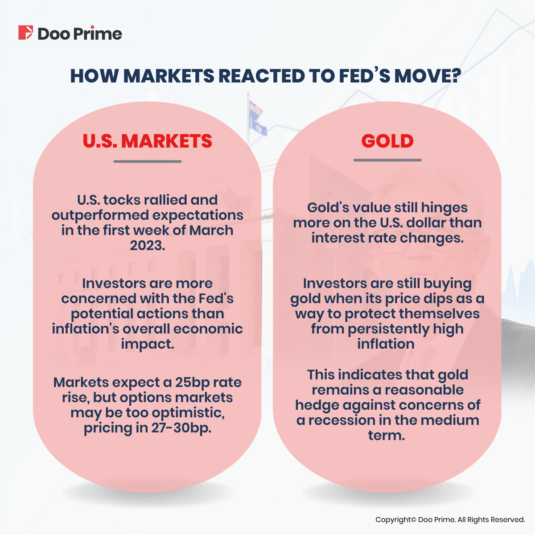

U.S. Markets

U.S. stocks defied the bearish consensus and posted solid gains for the first week of March 2023. This was attributed to positive news on business sentiment, mixed consumer activity, and rising U.S. 10-Year Treasury yields, which had less of an impact on stocks than in the past.

Unlike last year, when policy shocks were the main driver of market shifts, this year’s price action is influenced by both improving global growth and tighter global policy, which is more favorable for stock market operators.

Although inflation is still a major concern, investors are more worried about the Fed’s potential actions than the broader economic impact of inflation.

In October, concerns were raised that uncontrolled inflation expectations could lead to long-term growth disruptions similar to those experienced in the 1970s.

With the March FOMC meeting approaching, markets are predicting a 25bp increase in rates, but options markets may be too complacent, pricing in 27-30bp.

This provides investors with an opportunity to cheaply hedge against hawkish risks, especially given the upcoming catalysts from the Payrolls report, CPI and PCE inflation reports, alongside China’s Two Sessions meeting.

Gold

Gold, on the other hand, continues to be influenced by the value of the U.S. dollar rather than fluctuations in interest rates.

Investors are still buying gold when its price dips as a way to protect themselves from persistently high inflation and the increase in geopolitical risks.

Despite the U.S. 10-year Treasury yield reaching 4%, the persistent inversion of the 2-year and 10-year Treasury yields (-0.89%) is preventing gold from dropping below certain technical levels.

This indicates that gold remains a reasonable hedge against concerns of a recession in the medium term.

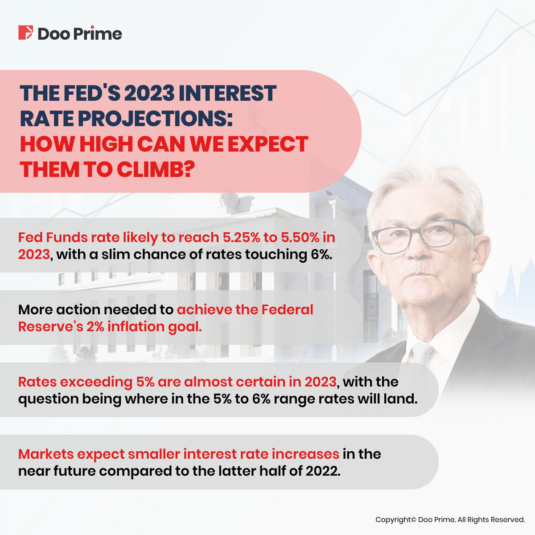

The Fed’s 2023 Interest Rate Projections: How High Can We Expect Them to Climb?

According to current market expectations, the Fed Funds rate is likely to reach 5.25% to 5.50% in 2023, with a slim chance of rates touching 6%, although it is less probable.

This is due to the fact that although inflation rates may have peaked, certain prices continue to rise, indicating that more action is needed to achieve the Federal Reserve’s 2% inflation goal. In addition, this concern has put pressure on equity markets lately.

The interest rate futures suggest that the Fed will raise rates at upcoming meetings in March, May, and June, with the possibility of further hikes beyond June, including a larger 0.5-percentage-point move.

Although the Fed is still expected to be close to the top of its interest rate cycle, rates exceeding 5% are now viewed as almost certain in 2023, with the question being where in the 5% to 6% range rates will land.

One reason for this shift in market expectations is that although inflation is trending down, it is not decreasing as rapidly as desired by the Fed.

There are concerns that the jobs market and economic growth are holding up better than anticipated, which may lead to further upward pressure on prices.

The Fed aims for a 2% annual inflation rate but is worried about not reaching it.

However, the Fed faces challenges due to the lagged effects of monetary policy. Higher interest rates are believed to have a restrictive impact on the economy only around a year later.

For now, the Fed is fine-tuning interest rates as economic data comes in, involving slightly higher rates.

Ultimately, recent hikes have been smaller than those seen in the second half of 2022, and the markets anticipate smaller interest rate moves to continue in the first half of 2023.

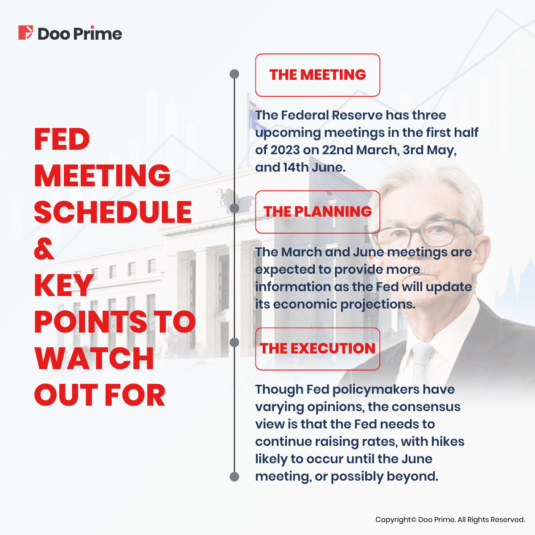

Federal Reserve Meeting Schedule and Key Points to Watch Out For

The Federal Reserve has three upcoming meetings in the first half of 2023 on 22nd March, 3rd May, and 14th June. The interest rate announcement will be made at 2 pm ET, followed by a press conference at 2.30 pm ET.

The March and June meetings are expected to provide more information as the Fed will update its economic projections. Since the Fed only holds eight meetings per year, there is no meeting scheduled for April.

Currently, the market predicts a 0.25-percentage-point increase in rates at each of the upcoming meetings, with rates likely to remain steady in the second half of the year.

The Fed’s updated economic projections in March will offer insight into where interest rates are headed in 2023.

Although it is expected that rates will likely peak at 5-6%, the projections may provide more precise information on the exact range.

Recent months have pushed back expectations of the Fed ceasing rate hikes by July due to high inflation. If economic data continues to indicate high inflation, the Fed may continue raising rates through the summer.

However, if the economy’s performance changes, the Fed may become more cautious about raising rates to avoid increased downside risks.

Further rate hikes are expected in the upcoming meetings if inflation remains high, but the real question is what the Fed has planned for the summer and whether the U.S. can avoid a recession despite high interest rates.

The Fed’s upcoming meeting on 22nd March 2023 will be informative for investors to adjust their expectations for interest rates in 2023, with the updated Summary of Economic Projections providing insight into the Fed’s predictions.

Though Fed policymakers have varying opinions, the consensus view is that the Fed needs to continue raising rates, with hikes likely to occur until the June meeting, or possibly beyond.

| About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime is an international pre-eminent online broker under Doo Group, which strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 90,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe : +44 11 3733 5199

Asia : +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China : +86 400 8427 539

E-mail:

Technical Support: en.support@dooprime.com

Account Manager: en.sales@dooprime.com

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.