The Federal Reserve’s expected rate cut on September 18 has become a key focus for financial markets. Recent statements from Fed Chair Jerome Powell and the minutes from the Federal Open Market Committee (FOMC) meetings have strengthened the case for a rate cut, as the central bank shifts its policy stance from combating inflation to supporting economic growth.

Powell’s recent comment that “the time has come” has only intensified speculation around the size of the potential cut, leaving investors and economists pondering the broader implications.

Market Expectations and Predictions

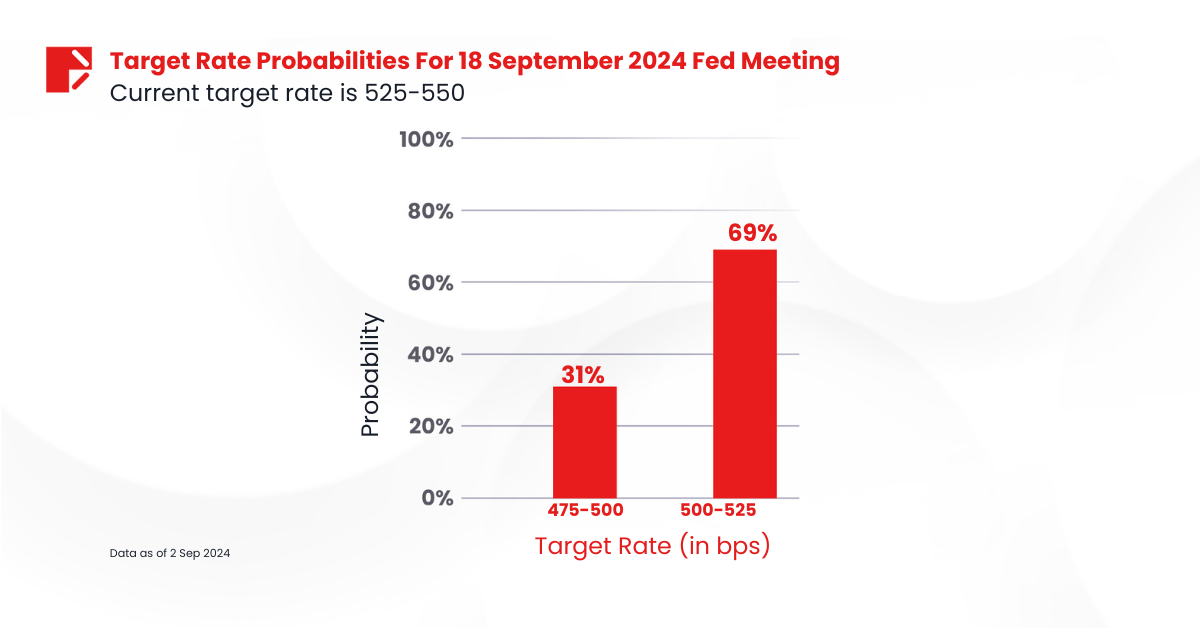

As the Fed’s September meeting draws near, expectations for a rate cut are growing. According to CME’s FedWatch Tool on Monday, there is a 69% likelihood of a 25-basis-point rate cut, while the probability of a more substantial 50-basis-point reduction stands at 31%.

The minutes from the FOMC’s July meeting hinted that some policymakers were already considering a cut, with “several” participants observing that the recent progress on inflation and increases in the unemployment rate provided a plausible case for reducing the target range by 25 basis points. Although no cut was made in July, these signals, combined with Powell’s recent comments at the Jackson Hole Economic Symposium, suggest a September rate cut is highly likely.

Powell Signals Cuts Are Coming

In his speech at the Jackson Hole Economic Symposium, Jerome Powell strongly indicated that a rate cut is on the horizon. “The time has come for policy to adjust,” Powell stated. “The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

While Powell refrained from giving a precise figure, his remarks at the conference were clear: the central bank is prepared to adjust its policy to prevent further weakening and to guide the economy towards a “soft landing.”

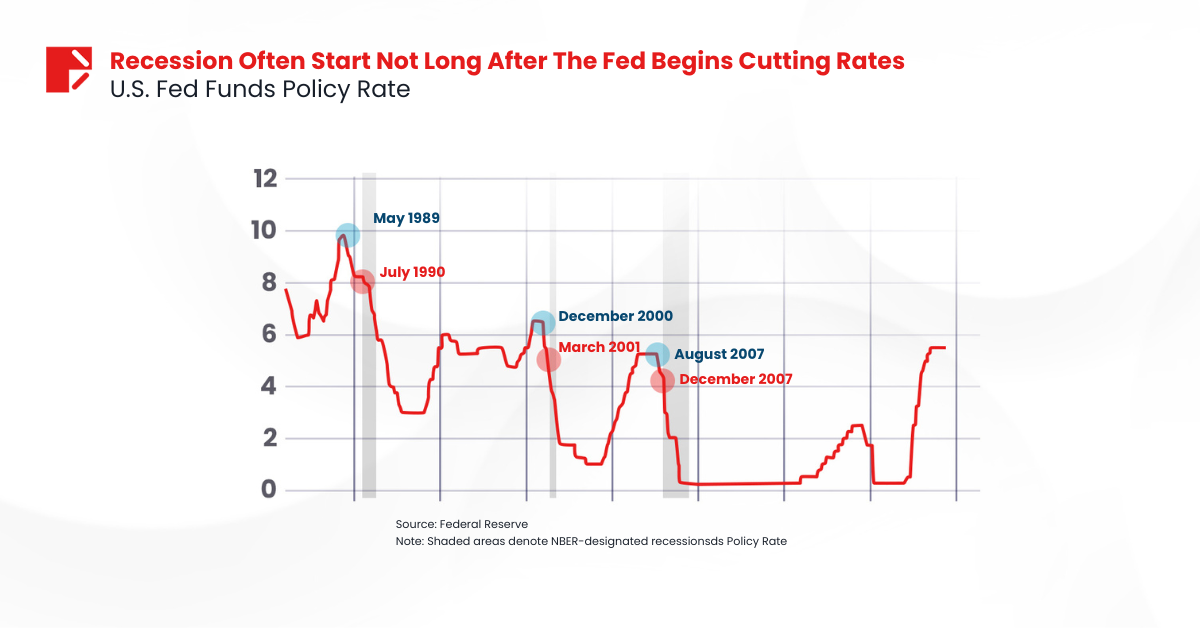

Historical Patterns: Rate Cuts and Recessions

Historical data show that nearly every time the Federal Reserve has cut rates, a recession follows shortly after. For example, data from the St. Louis Fed demonstrates that in almost all instances since 1955, a rate cut preceded an economic downturn. This is not to say that rate cuts cause recessions; rather, they often signal that the economy is already slowing down, prompting the Fed to act. By the time a recession is officially declared, it’s often months after it has already begun, making rate cuts a reactive rather than a preventative measure.

The yield curve spread, particularly the difference between the 10-year and 2-year Treasury yields, is another widely recognized indicator of recession. Historically, an inverted yield curve—when short-term interest rates are higher than long-term rates—has often preceded a recession. Currently, the yield curve has been inverted for over two years, the longest period of inversion in recent history. While some argue that “it could be different this time,” such an inversion has been a consistent recessionary signal in the past.

Fed Rate Cuts: Balancing Economic Growth and Investor Sentiment

Interest rate cuts can stimulate economic activity by lowering borrowing costs, but the magnitude of the cut can influence market sentiment in different ways:

- A Smaller Cut (25 Basis Points): This more conservative approach is seen by some experts as a prudent move that could maintain investor confidence. With a 69% chance of this scenario according to market data, a 25-basis-point reduction might be perceived as the Fed’s attempt to cautiously ease monetary policy without signaling panic, thereby providing a steady, gradual path toward economic support.

- A Larger Cut (50 Basis Points): A more aggressive cut could accelerate economic growth by making borrowing cheaper, but it also comes with risks. The 31% probability of a 50-basis-point cut suggests that while less likely, it is still on the table. Such a move might signal that the Fed sees greater economic risks ahead. Powell also hinted that the Fed might consider this option if it believes that the job market is in more immediate danger, emphasizing, “We do not seek or welcome further cooling in labor market conditions.”

The Fed’s Balancing Act

Several factors will weigh heavily on the Fed’s decision:

- Inflation Trends: Recent data indicates that inflation is cooling, which has provided the Fed with more flexibility. After more than a year of maintaining rates at 5.3%, the highest in over two decades, officials now seem confident enough to pivot. “The upside risks to inflation have diminished,” Mr. Powell noted, indicating that a rate cut is likely.

- Economic Indicators: The Fed is closely monitoring indicators like GDP growth, employment data, and consumer spending. While inflation has moderated, the job market is showing signs of strain, with the unemployment rate rising slightly and concerns about labor market conditions increasing. Powell emphasized, “The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

- Investor Confidence: The central bank also has to consider how its decisions might affect market sentiment. A larger cut could unsettle markets if perceived as a sign of deeper economic troubles. Recent market movements have shown optimism, with the S&P 500 edging closer to a record high and government bond yields falling as investors anticipate steeper rate cuts.

FOMC Projections and Future Rate Expectations

Looking ahead, the FOMC has three remaining meetings in 2024 — in September, November, and December. If the Fed decides to cut rates this year, it will have these three opportunities to do so. The CME’s FedWatch Tool forecasts that the federal funds rate could end 2024 between 4.25% to 4.5%, which is a full percentage point lower than current rates. While there is uncertainty around this estimate, the forecast suggests materially lower rates by December, potentially indicating further economic weakening, especially in the labor market.

As the Federal Reserve gears up for its rate cut decision on September 18, it faces a complex balancing act. The potential rate cut is not just a technical adjustment but a signal of the Fed’s confidence in its progress against inflation and its commitment to sustaining a strong labor market. With economic data continuing to unfold, the central bank’s decision could set the tone for the economy and financial markets in the months to come. Whether they opt for a modest 25-basis-point reduction or a more aggressive 50-basis-point cut, the outcome will significantly influence the trajectory of both the U.S. and global economies.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.