Today’s News

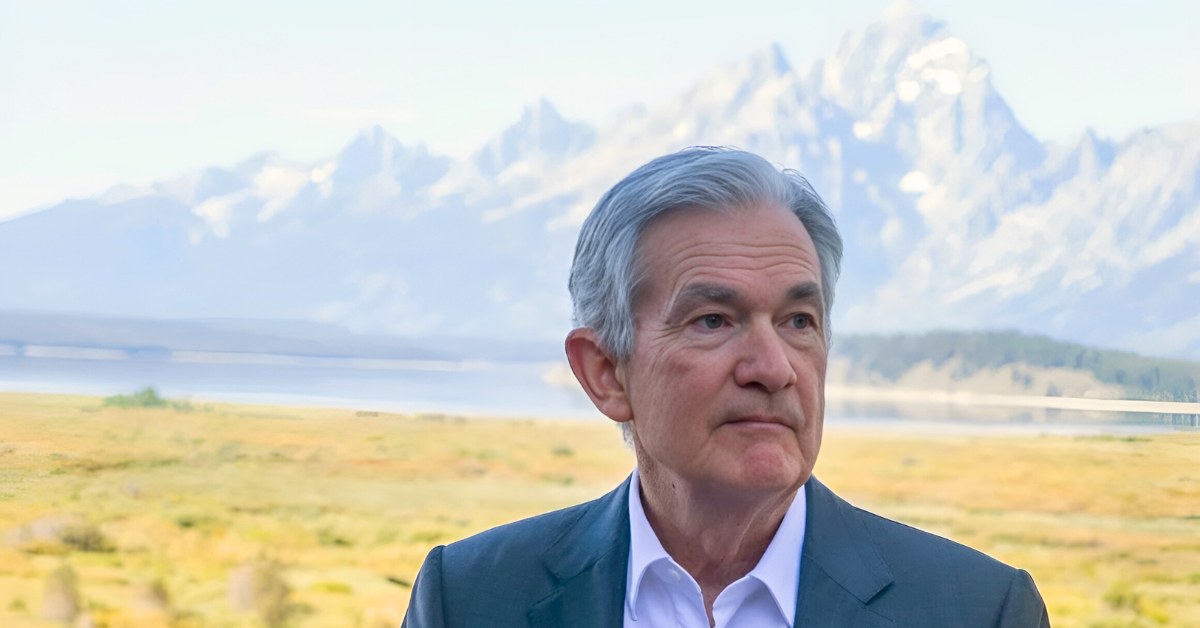

Asian shares remained cautious on Friday, while the U.S. dollar rebounded from its lowest levels in a year, as investors become more cautious ahead of Powell’s speech at Jackson Hole.

Markets are looking for confirmation that U.S. interest rate cuts will begin in September.

Image Source: Arab News

The Japanese yen strengthened by 0.3% to 145.77 per dollar, and bond yields edged up following remarks from Bank of Japan (BOJ) Governor Kazuo Ueda, who addressed lawmakers earlier in the day.

Although traders see little chance of a BOJ rate hike in October, Ueda maintained that the central bank is ready to raise rates if economic conditions align with its forecasts.

Data released earlier showed that Japan’s core inflation accelerated for the third consecutive month. However, the slowdown in demand-driven price increases suggests that there is no immediate urgency for rate hikes.

Krishna Bhimavarapu, APAC economist at State Street Global Advisors, noted that the stronger yen and reintroduction of energy subsidies could slow inflation in the near term, adding, “If the data evolves as we expect, it could mean that the next BOJ hike may not come until December as fears of rapid inflation ease to an extent.”

On Friday, MSCI’s broadest index of Asia-Pacific shares outside Japan fell by 0.4%, though it was still on track for a weekly gain of 0.6%. Japan’s Nikkei index remained flat near three-week highs, while China’s blue-chip index rose by 0.3%. Meanwhile, Hong Kong’s Hang Seng index dropped by 0.4%, and South Korea’s KOSPI index declined by 0.5%.

Markets Turn Cautious Ahead of Powell’s Jackson Hole Speech

Image Source: Associated Press

Overnight, Wall Street saw a downturn as sentiment became more cautious ahead of Powell’s speech at Jackson Hole. Three Fed officials hinted at a possible rate cut in September, advocating for a “slow and methodical” approach.

Robert Carnell, regional head of research for Asia-Pacific at ING, pointed out that Powell’s upcoming speech has the potential to either excite or disappoint markets, depending on how it aligns with current market expectations. “As any decision that deviates from market pricing will rest on as yet unknown data, it is hard to see how Powell can commit to much beyond some easing of some sort in September, and even then, only barring data accidents,” Carnell said.

Treasury yields fell slightly on Friday after rising for the first time in five sessions on Thursday. The 10-year yield slipped by 2 basis points to 3.8426% in Asia, while the two-year yield dropped by 3 basis points to 3.9845%.

Despite the declining yields, the dollar managed to recover from selling pressure overnight. The euro pulled back from its one-year high, facing resistance at $1.1139. Wall Street futures gained between 0.2% and 0.4%, while commodities appeared poised to end the week lower.

Brent crude futures remained flat at $76.04 per barrel but were down more than 3% for the week due to rising U.S. crude inventories and a weakening demand outlook in China. Gold prices fell by 0.7.

Other News

TD Bank Reports First Loss in 20 Years Amid U.S. Probe Costs

TD Bank posted its first loss in over two decades after setting aside USD 2.6 billion to cover potential fines related to U.S. regulatory probes into its anti-money laundering controls.

China and Belarus Boost Trade and Security Ties

China and Belarus have agreed to deepen cooperation in trade, security, energy, and finance after a meeting between Chinese Premier Li Qiang and Belarusian Prime Minister Roman Golovchenko.

U.S. Bank Rules and Capital Hikes Depend on Election Outcome

The finalization of controversial bank capital hikes and other Wall Street regulations may depend on the November election, with potential delays risking revisions or cancellation under a new administration.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above strategies reflect only the analysts’ opinions and are for reference only. They should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.