Today’s News

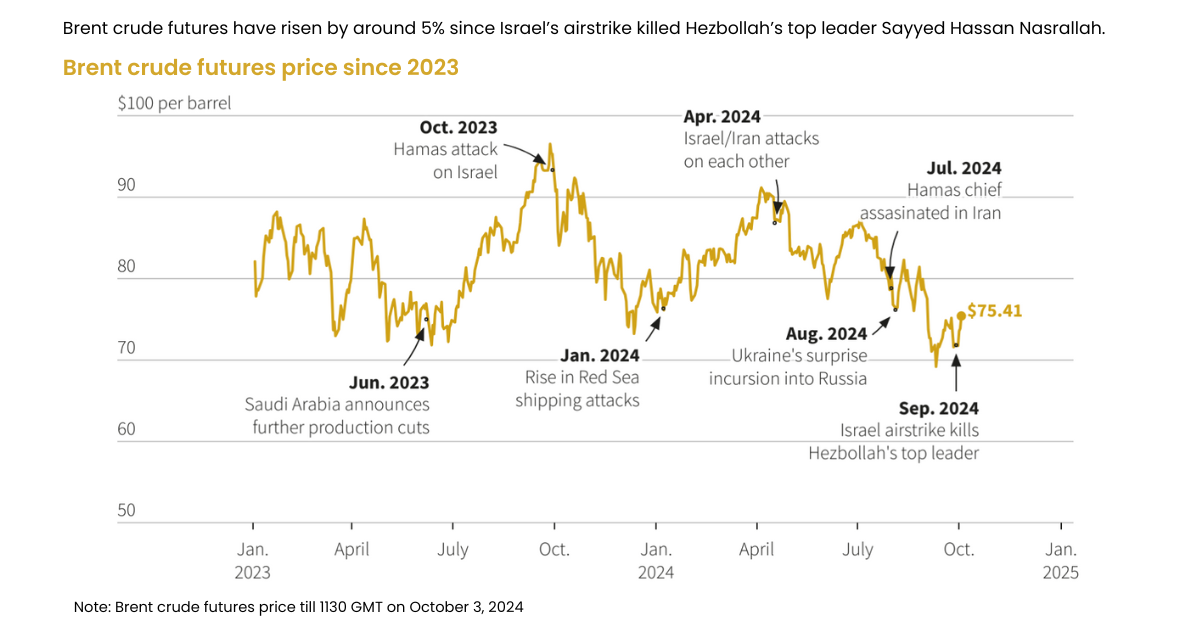

Oil prices are on track for their largest weekly increase in over a year, driven by escalating tensions in the Middle East that have unsettled global markets ahead of the weekend.

Brent crude futures are poised to rise about 8% for the week, marking their steepest gain since February 2023, while U.S. crude futures are up 8.2%, the largest weekly increase since March last year.

Image Source: Reuters

Despite gains in most equity indexes and stock futures, market optimism was tempered by concerns that Israel might soon launch retaliatory strikes on Iran. U.S. President Joe Biden tried to calm fears, stating he does not believe there will be an “all-out war” in the Middle East, though he previously mentioned discussions about potential U.S. strikes on Iran’s oil infrastructure in response to Tehran’s missile attacks on Israel.

Even as oil prices recover from recent lows, global stocks and investor sentiment are feeling the strain. Should geopolitical tensions persist and oil prices continue rising, investors may need to revise their inflation expectations.

Oil Markets are Wary of a Middle East Escalation

Source: LSEG Datastream, Reuters, October 3,2024 by Vineet Sachdev

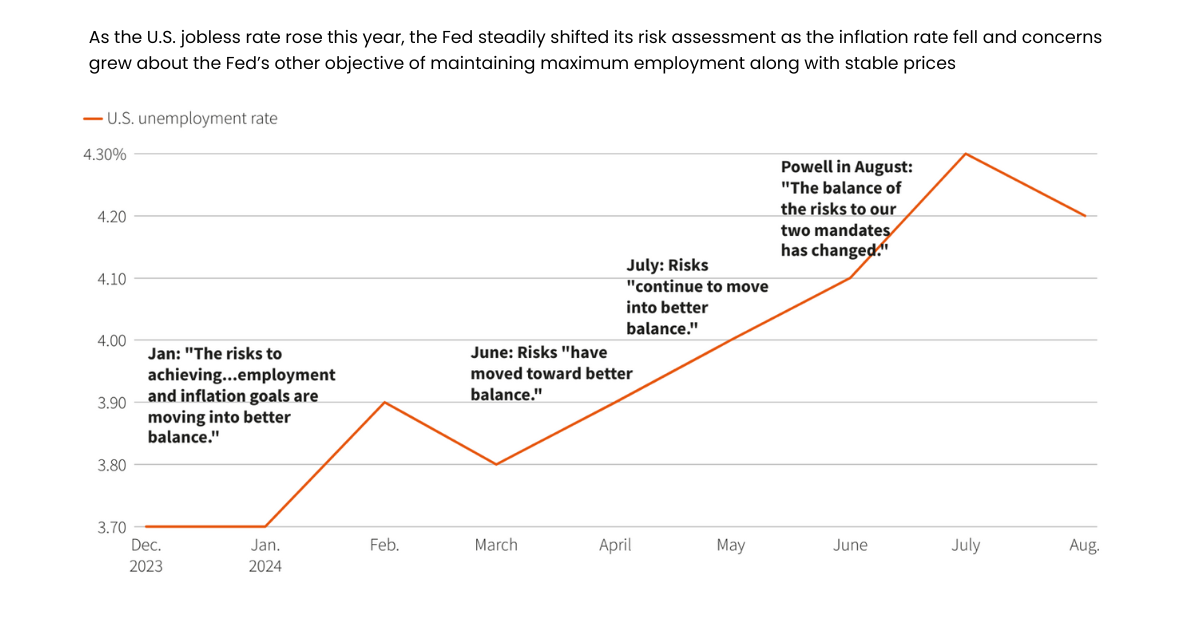

Federal Reserve Chair Jerome Powell is likely keeping a close eye on these developments. His recent remarks suggest the U.S. central bank will stick to gradual quarter-percentage-point rate cuts, as he remains cautious about easing too quickly and risking a resurgence in inflation.

The resilience of the U.S. economy, especially evident in the labor market and services sector, supports a slower pace of rate cuts.

Later today, September’s nonfarm payrolls report is set to take the spotlight, with recent data pointing to continued strength in employment. Investors will also focus on speeches from European Central Bank policymakers and Bank of England’s chief economist, Huw Pill.

Rising Unemployment, Rising Risk

Source: Bureau of Labor Statistics, U.S. Federal Reserve, Reuters

Elsewhere, in a positive development, U.S. East Coast and Gulf Coast ports reopened Thursday night after dockworkers and operators reached a wage agreement, ending the largest work stoppage in nearly 50 years.

Key factors to watch on Friday include the U.S. nonfarm payrolls report for September, and speeches from the Bank of England’s Huw Pill and various European Central Bank policymakers.

Other News

Asia Stocks Fall, Oil Gains Amid Tensions

Asian stocks dropped as Middle East tensions fueled a sharp weekly oil price rise. Investors await the U.S. jobs report for clues on future Fed rate moves.

U.S. Port Strike Ends, Delays Remain

U.S. East and Gulf Coast ports reopened after a wage deal ended the largest strike in decades, but clearing ship backlogs will take time.

Spirit Airlines Considers Bankruptcy Talks

Spirit Airlines is in discussions with bondholders about a potential bankruptcy filing following its failed JetBlue merger, sending shares down 30%.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above strategies reflect only the analysts’ opinions and are for reference only. They should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.